These 5 Mid-Cap Stocks offer Higher yields and preferred at Barrons

May 6 2023

When it comes to dividend stocks, large-cap names command a lot of attention.

But the likes of Johnson & Johnson (ticker: JNJ), AT&T (T), and Coca-Cola (KO) aren’t the only places to find nice yields. Mid-cap stocks are worth a look as well.

For this screen, Barron’s started with the S&P MidCap 400, which sports an average yield of about 1.7%—in line with the S&P 500 .

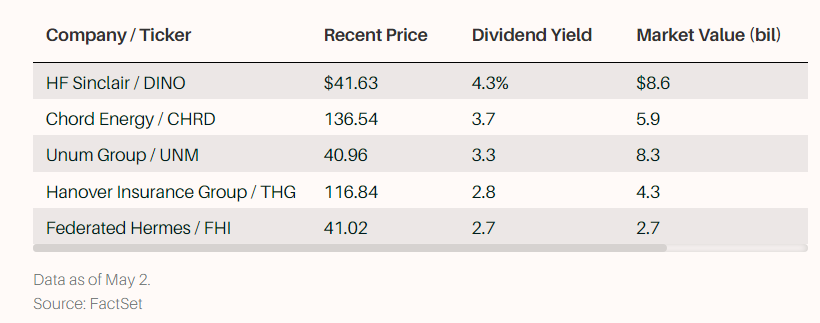

Using FactSet data, Barron’s looked for stocks with dividend yields of at least 2% and debt-to-equity ratios below 50%. Our reasoning was that the less debt company has on its balance sheet, the better—especially amid concerns about a possible recession later this year.

These five mid-cap ccompanies have yields of at least 2% and lower percentages of debt in their capital structures.

quotes: DINO, CHRD, UNM, THG, FHI

source: barrons.com